What is a safe strategy to earn 10 crores in 15 years from the stock market?

What is a safe strategy to earn 10 crores in 15 years from the Indian stock market?

Never the less let us make a strategy to make 10 crores in 15 years

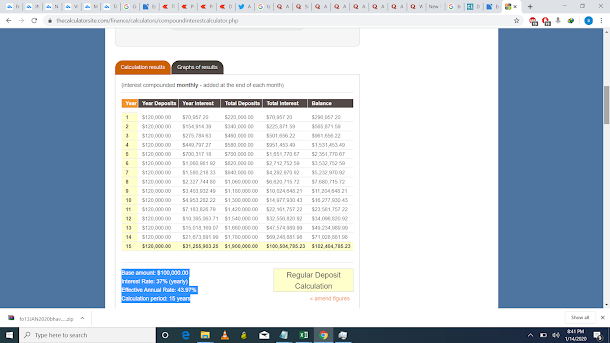

Starting amount: 100,000.00 (1 lakh)

Interest Rate: 37% (yearly)

Effective Annual Rate: 43.97%(compounded)

Calculation period: 15 years

Every month you need to deposit 10,000 Rs in your trading account

IF you are able to do the above for next 15 years you will end up with 10 crore rupees

For eg you can only trade for Bull flag pattern for the next 15 years.

You can search for this on google what exactly is a Bull flag pattern

Tata steel for the last 15 days have made so many bull flag patterns. and have given easily 10–15 % in 15 days

Note :Our target is to make 37 % annually .

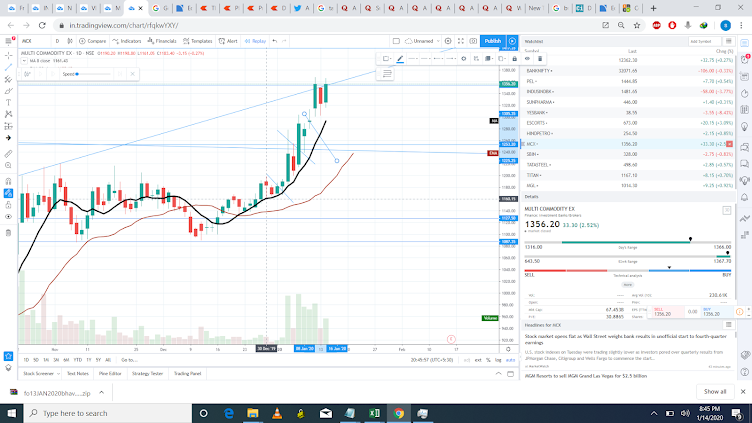

Similar case with MCX

This is just a idea,you can perfect this and use for next 15 years and you will end up with more than what you want

IF this was useful please upvote and follow

edit:

Bull flag Patterm

What is a Bull Flag Pattern?

A bull flag pattern is a chart pattern that occurs when a stock is in a strong uptrend. It is called a flag pattern because when you see it on a chart it looks like a flag on a pole and since we are in an uptrend it is considered a bullish flag.

A bullish flag pattern typically has the following features:

- Stock has made a strong move up on high relative volume, forming the pole

- Stock consolidates near the top of the pole on lighter volume, forming the flag

- Stock breaks out of consolidation pattern on high relative volume to continue the trend

How to Trade The Bull Flag Pattern

Checklist for trading bull flag patterns:

- Stock is surging up on high relative volume, preferably from a news catalyst.

- Prices consolidate at or near highs with a defined pullback pattern.

- Buy when prices breakout above the consolidation pattern on high volume.

- Place stop order below bottom of consolidation pattern.

- Profit targets should be at least 2:1 risk/reward.

The main thing to look for in this pattern is volume. Volume confirms major moves and the likely hood that a breakout will be successful.

The second thing you have to look for is a defined descending trend line that you can watch as the point of breakout. This will be the top part of the flag. In the bullish flag pattern above you can see that the trend line is very recognizable and defined so when it did finally punch through price jumped up very quickly. You can also see how neatly the line connects to the other moves up that were rejected (3 points of contact including the high of the flag pole).

Bull flag patterns do have a statistical edge if traded correctly but in the event the set up fails you need to know where to get out. Or more definitively, the point on the chart where you know that this set up is no longer working out and it’s time to jump ship.

There are a couple of different ways to manage this trade. The most common is to place a stop below the consolidation area. In the example above, you can see the line drawn out on the bottom of the flag pattern. This is the point where you know that this setup is no longer working out and its time to take a loss and move on.

The other way is to use the 20-day moving average as a stop. So if prices close below that moving average then you would close out your position.

I Hope you liked my article, You can help me in producing more such article in future by giving some donation!!!

You can donate here

UPI: 9986002107@upi

:>

-Thank You

Comments

Post a Comment